When Stock Performer started in 2010, there were a lot of complaints that the stock industry was dying. The rush of the agencies to implement subscription models, triggered mostly by Shutterstock’s success, led to a lot of uncertainty about photographers’ income. After all, customers were able to buy images for mere cents now. Talks of impending doom was nothing new, however. When microstock, cheap equipment, and the internet entered the scene a few years earlier, everyone earning a few hundred dollars per sale before certainly thought it was going to be the end of their career.

Today, a new perceived threat is on the rise: AI-generated imagery. And again, stock producers are asking themselves: Is the stock industry going to die? Should I quit photography or stock altogether? Or should I go all-in on producing AI images? Any such business decision should always be driven by data. Stock producers are not in the art industry, their goal is to satisfy market demands for visual media. In this blog post, we will attempt to answer some of these questions from a data perspective.

About the Data Presented Here

We have compiled the data in this blog post from what’s available to us at Stock Performer and for which we have permission from our users. Not all stock producers are Stock Performer customers and not all of our customers have opted into this usage. (Opting into this also gives our customers additional functions such as a market ranking.) So while it affords us with some insight, it is not the full picture and should thus be taken with a grain of salt. It should also be mentioned that these are all averages. Many stock producers will see numbers that are wildly different from what’s shown here.

Finally, AI-generated imagery is quite new. There is not a lot of data yet. Many contributors have not even tried it at this point, agencies are still adapting to it, the buyers market is still familiarizing itself with it, and the technology is still rapidly evolving in this area. We expect that a year from now, things will look very different from today. It’s still early days. We will likely post an update at some point and we expect that the numbers will be very different. So this is more of a preliminary snapshot and not a final verdict.

How Is the Stock Industry Affected as a Whole?

It is easy to assume that since powerful text-to-image tools such as Midjourney entered the scene, stock market revenue has been rapidly declining. But is this really true? Here are the charts for the top three stock agencies, each showing contributor-averages for revenue (blue bars), downloads (red lines), and uploads (grey areas, on a separate scale):

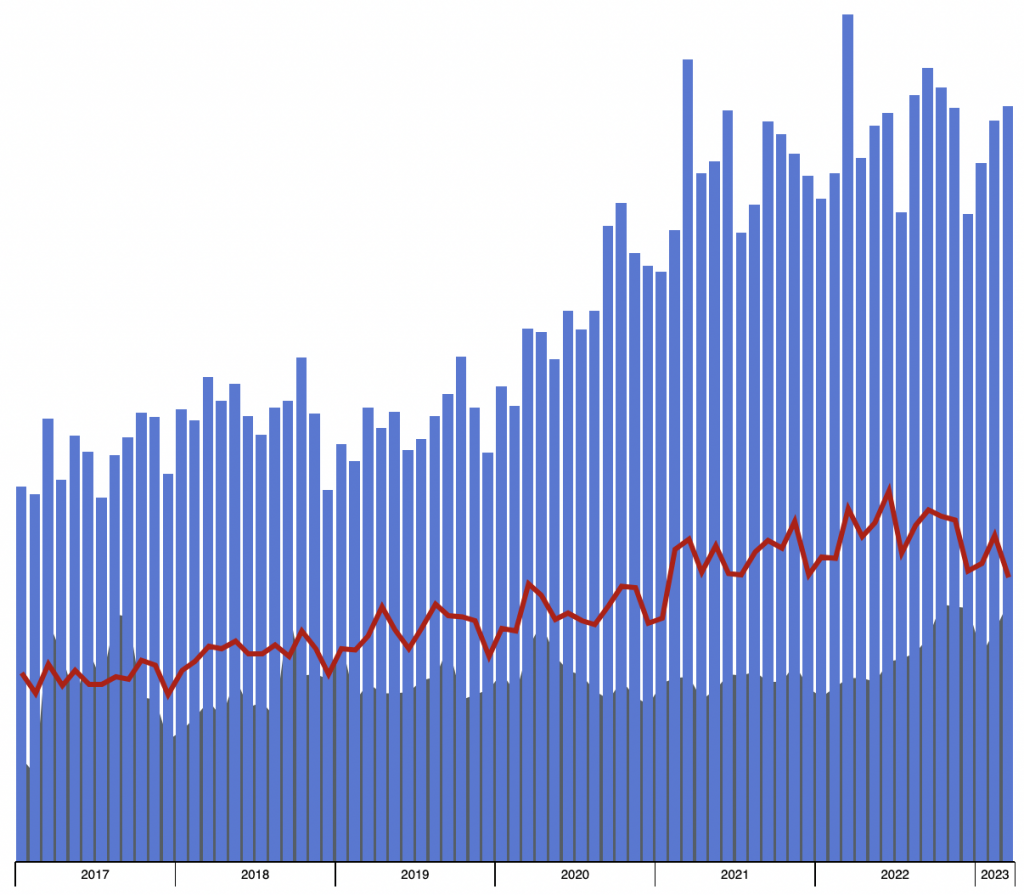

iStockphoto

We can see a steady increase in revenues since 2017 for iStockphoto. Covid seems to have supercharged this increase in 2020 and 2021 — despite relatively stable upload counts during the same time — and while it looks like this has been a temporary effect, sales remain at a high level and there is no clear indication of a major decrease in sales. iStockphoto is also the only one of the three big agencies that has a fairly large RPD (revenue per download) at around $2.50 per sale.

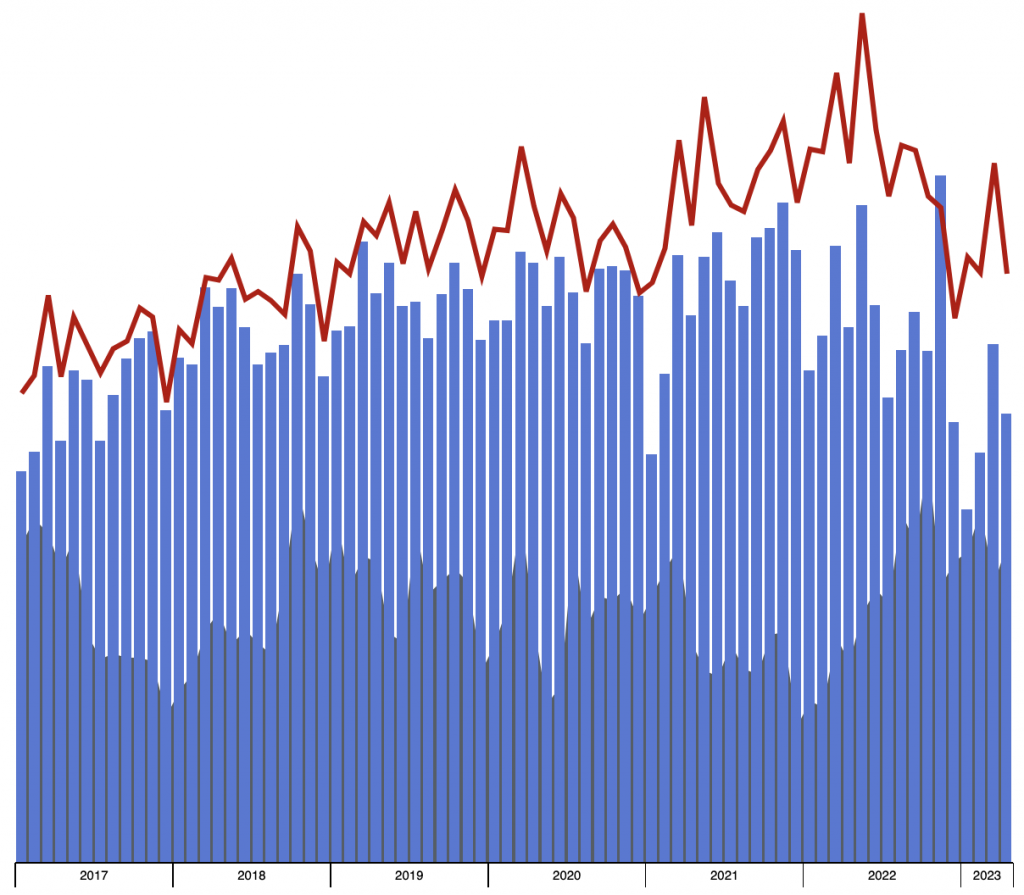

Shutterstock

Things look quite different for Shutterstock. RPD is quite low at almost always less than $1 which is not surprising as Shutterstock is known for selling stock at low prices but making up for it in volume. It looks like the last few months have been rough for many Shutterstock contributors. The number of monthly uploads has sharply increased over the course of 2022 but it does not look like it’s paying off yet. Is this due to the increasing popularity of AI? That’s doubtful, as the effects of AI are still unfolding. It is a time where large corporations are reducing their ad spend and this usually translates in reduced stock photo and video sales. Whether this is only temporary for Shutterstock is the big question.

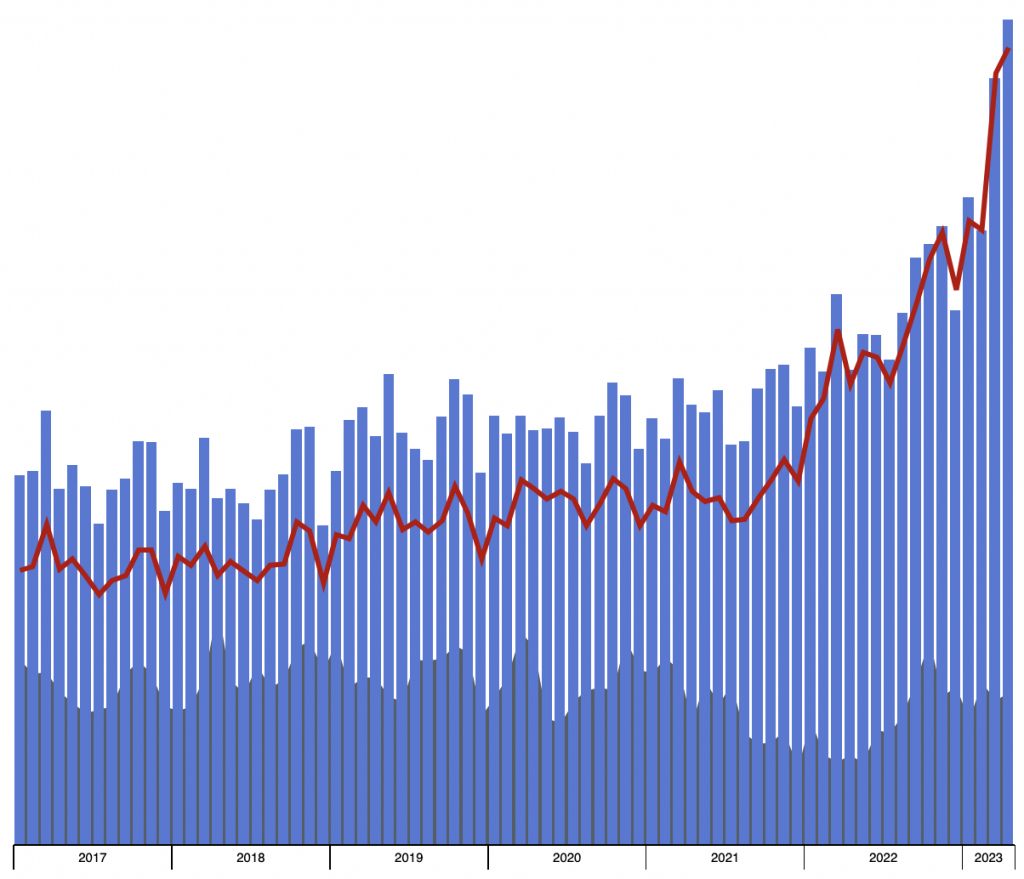

Adobe Stock

In comparison, income for Adobe Stock contributors has been steadily increasing, with a sharp upwards trend since the beginning of 2022. It looks like the economic downturn has no effect on Adobe Stock sales. This also does not seem to be a result of higher upload counts. The number of uploads have been more or less the same. In the context of this blog post, one wonders if this due to AI images whose sales started just around the time Adobe Stock’s revenue (and download counts) started climbing. As we will see further below, these additional sales are not AI sales, they only make up a small part of it. So if there is an “AI effect” at all, then it affects regular sales as well.

Again, these numbers are only based on the data we have at hand and for which we have permission to use them in these kind of analyses. And they are averages. Some contributors will see much worse charts for their own sales, others will outperform these numbers by a large margin.

How Many Producers Are Selling AI-Generated Images?

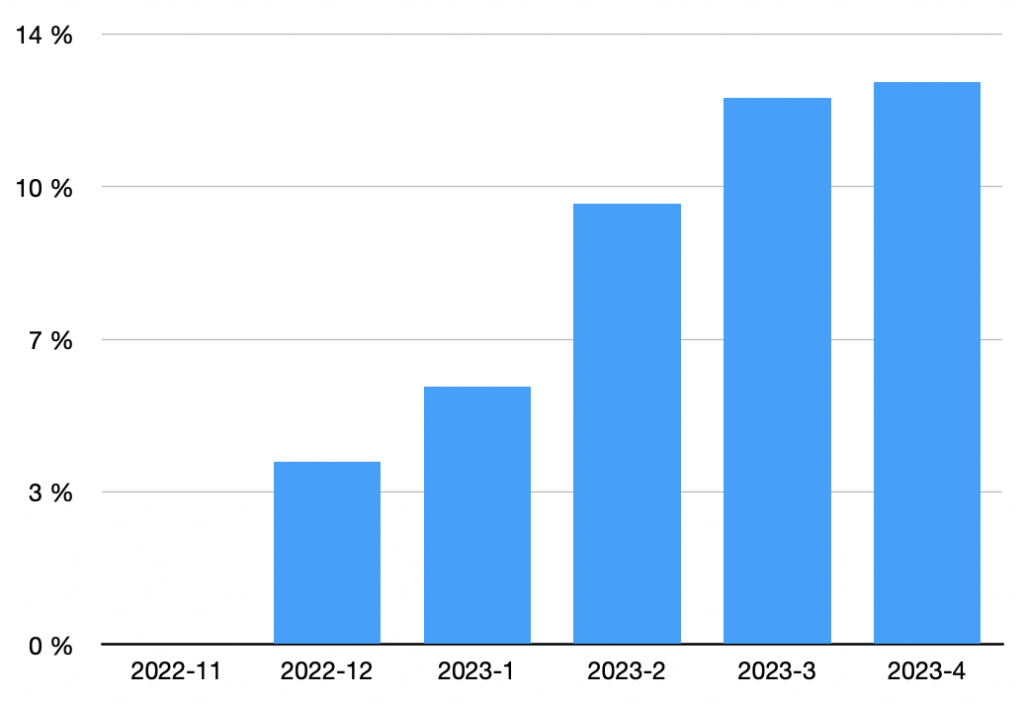

Getting into analyzing AI-generated uploads specifically, we have to define what they are. As of May 2023, of the big stock agencies, only Adobe Stock accepts the submission of AI-generated images. They have done so since the summer of 2022. However, only since December 2022 have they enforced submission guidelines for these images. AI images count as illustrations and they need to be tagged with the keyword “generative ai”. So we only have about half a year of reliable data for these types of images and they are only for Adobe Stock. How many Stock Performer customers have started uploading AI-generated images?

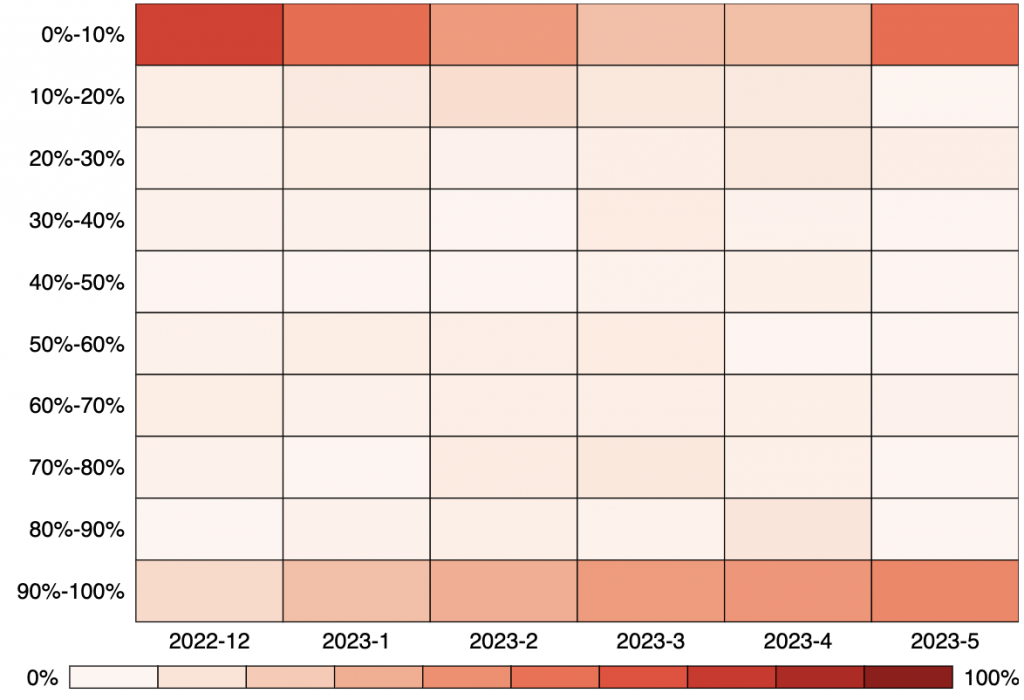

So at the time of this blog post, about 13% of Stock Performer customers who upload to Adobe Stock are uploading AI-generated images. Are they just toying with it? Or have they come to rely on AI-generated images completely? Here is the distribution:

This diagram only considers contributors who have uploaded at least one AI image to Adobe Stock in a given month. The vertical axis depicts the number of AI images produced in that month, compared to all images produced by that contributor in that month. The darker the red, the more contributors fall in that range. We can see that most photographers who upload AI images to Adobe Stock either just play around with AI a little (0%-10%) or have switched completely to producing AI images (90%-100%). There is not a lot inbetween. It also seems that the number of contributors who have fully switched to AI content is growing. Whether or not this will pay off, a considerable number of stock producers believe their future to be in AI content only.

How Well Does AI Sell?

One of the metrics we show for collections in Stock Performer is “STR”, short for “sell-through rate”. This is the percentage of files that have had at least one sale. Looking at all Adobe Stock files since 2022, we get a sell-through rate of 13%. Or, put another way, 87% of all Adobe Stock files created since 2022 have not made a sale yet. (The STR for all non-AI images is the same, 13%.) How does this compare to AI-generated images?

The sell-through rate for AI-generated images is somewhat lower, at 9%. So at this point, more AI-generated images don’t sell on average. To many contributors, this may not be a problem because it is much more cost-effective to produce large volumes of images than it is with traditional photography. It is also worth noting that the difference is not that big and over time, this value will likely approach Adobe Stock’s average as in general, sales for files take some time to pick up. We can say that AI-generated images are definitely being bought. Although text-to-image tools are available to everyone now, many buyers still appear to resort to stock agencies to get the images they need. This is not surprising because prompt engineering is a skill just like photography is and for many buyers, it is easier to buy AI-generated images off-the-shelf rather than to create them themselves.

More important than STR for contributors, however, is RPI/m, which is short for “revenue per image per month”. This metric answers the following question: For each file you produce, how much money can you expect to make on average per month? Adobe Stock’s RPI/m for any file is 3.75 cents. Compare that to AI-generated images at Adobe Stock, for which the RPI/m is 17 cents. That is quite good. Given that the STR is lower, this means that each AI sale earns more money than other files. The RPD, short for “revenue per download”, confirms this: Overall it is $1.22 for Adobe Stock vs. $1.94 for AI-generated images on Adobe Stock. Over time, we expect this number to go down as more AI-generated images enter the market and there is more competition. Rumours are Adobe Stock is getting so many AI image submissions, they are falling way behind with inspections. Looks like we’re seeing some kind of AI gold rush at the moment.

What Type of AI Images Are Buyers Looking For?

The following table shows the top 20 keywords, sorted by revenue, by number of downloads, and by number of uploads (i.e. what is being produced), excluding the prescribed keywords such as “generative” and “ai”:

| By revenue | By downloads | By uploads |

|---|---|---|

| nature | design | design |

| design | background | modern |

| art | nature | art |

| sky | art | futuristic |

| landscape | abstract | colorful |

| light | light | creative |

| background | concept | woman |

| travel | decoration | abstract |

| blue | style | background |

| colorful | modern | innovation |

| green | architecture | contemporary |

| water | landscape | style |

| summer | interior | digital |

| white | home | nature |

| black | graphic | concept |

| abstract | blue | portrait |

| architecture | house | bright |

| modern | view | graphic |

| color | beautiful | technology |

| decoration | celebration | female |

Many of these keywords are obviously not very informative, “blue” or “white” doesn’t tell us much about the images’ content. (As a side note, keyword analytics is hard. Stock Performer will eventually launch keywords analytics but it needs to be useful and we are still working on a good keyword analytics concept.)

However, the overall theme for AI images appears to be mostly abstract illustrations rather than realistic photography-like images. This also becomes obvious when we look at the all-time AI image top sales. Many of the AI bestsellers are conceptual images or abstract wallpaper-style illustrations. We cannot show actual images of our customers to the public but here are images capturing the style of the top sellers:

Realism exists but is much more rare. In those instances, we typically find architecture, portraits, or food in the top sales list:

To observers of the AI imagery space, this is not surprising. Midjourney v5 has only been out for a few weeks so we’re starting to see more convincing pictures of people now whereas before that, they have been rather difficult to create.

It is also likely that because Adobe Stock classifies AI images as “illustrations”, even when they look like photographs, sales will be predominantly from buyers looking for illustrations, resulting in high ranking keywords such as “abstract”, “background”, and “art”.

So far, it does not like like AI images have taken over high-quality stock photography, especially for images with models. We have not seen the typical “smiling business people shaking hands in a meeting room” in the top AI sellers. But this may change. We are already seeing very convincing pictures of AI-generated people as shown below. Note that these were generated with Midjourney v5 but Midjourney v5.1 has since been released (credit to Robert Kneschke):

It is clear that the AI space will put pressure on stock photographers to differentiate themselves from what’s possible with text-to-image tools. It may be good advice for every stock photographer to at least keep a close eye on what is possible with Midjourney and similar tools. Even if you don’t intend to upload AI images yourself, you will have to figure out what AI cannot do yet and focus on those themes. (Hint: Stock Performer is an excellent tool for this.)

Video is currently largely unaffected by AI as the quality of text-to-video tools is still lacking. Technology is progressing very fast on this front, however. We could be seeing high quality AI-generated videos in a few months already.

As it stands, illustrators may be experiencing a more difficult time already. Illustrations will likely not be in less demand but there will be much more competition. Especially the time and effort to create illustrations is greatly reduced with AI. Adobe Stock illustrators may be better off using AI tools to create their images.

So Is This the End?

Again, it’s too early to say where we are heading. But is the stock industry dead? Certainly not. Not right now and not in the short-term future. However, it is clear that AI text-to-image tools are transforming the industry. Many contributors will give up photography or hand-made illustrations and switch to these tools, if they haven’t already. And at the moment, this seems to be paying off. Images are cheaper to produce and at least at Adobe Stock, they generate higher revenue.

Unfortunately, this strategy is not available to everyone. Agencies such as iStockphoto or Shutterstock do not accept AI-generated images. Exclusive contributors who don’t upload to Adobe Stock won’t be able to profit from this trend. Will these agencies eventually follow? We don’t know. Shutterstock, for example, offers text-to-image tools to buyers instead. This means buyers have to learn how to enter the correct prompt. We have yet to see if this is a good strategy.

A big question yet unanswered is whether companies will cancel their stock subscriptions and resort to creating AI images in-house. Small companies may not have the resources to do that but larger companies surely do. And if they follow this path, it will certainly hurt agencies because it is these big accounts which generate the most revenue for stock agencies. Large companies are notoriously slow to respond to market changes, however, and professional AI prompt engineers are still rare. So if this happens, it won’t happen immediately.

In conclusion, at this point in time, there are still many unknown variables regarding AI-generated content. We will see how this will play out. At Stock Performer, our customers and we ourselves are monitoring this new trend very closely. Once some time has passed, we will be sure to publish an update to this blog post. This will hopefully provide us with more clarity about where the industry is heading.

Webmentions

[…] der Authentizität. Pro KI-generiertem Bild nehmen Künstler dem Analyseportal „Stockperformer“ zufolge im Schnitt 17 Cent im Monat ein. Das sei mehr als das Vierfache des Gesamtdurchschnitts auf der […]

[…] ストック画像専門の分析サイト「ストックパフォーマー」の2023年5月26日付の記事によると、同年4月時点で「アドビ・ストック」のアップロード画像におけるAI画像の割合は約13%に上る。 […]